NOTARIAL SERVICES ATTORNEY

PROBATE

To Live and Die in Thailand (estract of an article of Dr. CF Ciambrelli)

The importance of being provident (prevenant)... and to make a last will

As we all know, sooner or later "you" will die.

I don't know what will become of our souls, all I know is what will become of earthly possessions here in Thailand and how difficult it could be for our heirs to receive them after our "departure", especially if they live abroad.

Thai law grants us wide powers of discretion as to how to dispose of our assets. Provided that we have drawn up (rédigé) a testament (better if done with the help of an expert), we can freely dispose of our assets with the sole exception of the goods acquired after the marriage. In fact, if we are married, half of the patrimony acquired after marriage technically already belongs to the spouse and will be automatically assigned to her or him (See our article published January 2014, L'Indicateur N.2, also available online).

The remaining half of the patrimony if you are married, or the totality of it if you are single or divorced, can be bequeathed to anybody without restrictions. In other words, you can "disinherit" your children or anybody else and freely decide to whom to bequeath your properties without any limits.

Although it is true that Thai law gives us these wide powers of discretion which would be unthinkable in the majority of Western countries, when it comes to actually taking possession of an inheritance, things are not as easy as they might appear. If we truly care about our loved ones who will survive us, we had best be extremely prudent and provident "before" our passing.

For those residing in Thailand the procedure to acquire an inheritance can be relatively simple, especially if you have made a proper last will. A good lawyer can have everything sorted out for a moderate fee. Unfortunately the legal process becomes very difficult if your heirs live abroad, and even worse if you haven't drawn up a last will.

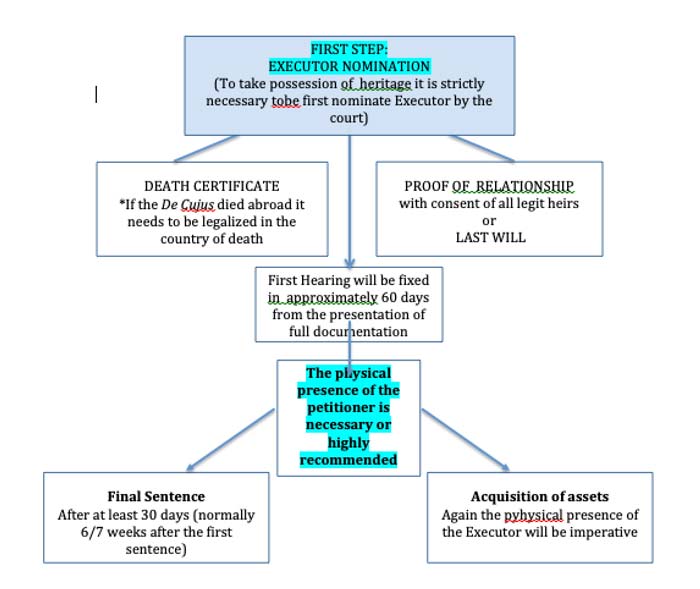

The first stumbling block is that to dispose of an inheritance in Thailand either the heir(s) themselves or another party must have been previously nominated as "Executor" by a local tribunal.

The procedure to obtain such nomination might present many difficulties and a well drawn up testament with the explicit nomination of the "Executor" will greatly help.

The procedure to obtain the nomination as Executor, which I repeat is essential to take possession of the assets of the deceased, requires three steps :

1) First step: A request to the court upon the presentation of a considerable number of documents, including the death certificate and the proves that the petitioner(s) is (are) the legitimate heir(s), or the legitimate appointed executor, all properly and legally translated in Thai.

To present the petition the physical presence of the petitioner (highly advisable) or an official proxy made by a notary, translated in Thai and verified by the embassy (Thai embassy abroad or foreign embassy in Thailand) is strictly required.

The heirs can also choose to appoint as Executor a lawyer or somebody of their absolute trust, assuming undeniable risks (the Executor can literally dispose of all the inheritance) and accepting to pay higher legal expenses.

2) Second step : Provided that the petitioner has presented all the required documentation, the hearing will normally take place in 60/90 days from the presentation of the request and would strictly require (!) the physical presence of the appointed Executor.

3) Third step: Achievement of final sentence.

The first sentence will be valid and accepted by private and public institutions (as land departments, banks, juristic persons etc.) only if jointly presented with the "declaration of final sentence". The court will release such a document 30 days after the first sentence (second step) provided that no appeals have been in the meantime presented by third parts.

Please note that, even though the law permits the possibility to appoint "anybody" as Executor, in reality, if the surname of the Executor is not the same as that of the legitimate heir, things can become terribly difficult. On the other hand, unless the heirs have in full trust appointed somebody residing in Thailand as Executor, it will be necessary for the Executor to remain in Thailand several months or to come here at least two times: one time to be appointed Executor by the court, one to get the final sentence and to finally take possession of the inheritance.

Unfortunately, this last, essential step is not as easy as you might think unless the "beloved departed" have been very provident as we will explain in the second part of this article.

Second part

The prerequisite to take possession of an inheritance in Thailand is to obtain a nomination as "Executor" from the competent court and the declaration of "Final sentence" (jugement définitif). The document, can be requested only 30 days after the first sentence.

Unfortunately, even though the "Final Sentence Certificate" is essential it might be not enough and more documents are requested to complete the procedures. If your heirs reside in Thailand, having plenty of time and being familiar with the local rhythm and ways of doing things, it won't be a big problem. Things drastically change if your heirs do not live in Thailand, haven't much time to wait and maybe they have come on purpose for a last salute and to quickly unravel the knot of the inheritance.

In such, very common case, here follows some advice that can really help anybody inheriting in Thailand :

COURT DOCUMENTS

It is essential to:

- ASK the court to give back all the original documentation that the appointed executor has previously presented to obtain the nomination.

- Make several copies and always keep the originals for they will be requested everywhere (Banks, Land Department, etc.), no matter that one has been already officially declared Executor by a Court of Justice.

HOW TO GET THE BANK DEPOSIT FUNDS

- The minimum time to withdraw the funds from a bank in case of inheritance, provided that all requested documents have been presented, can be a week or more. In case of fixED accounts or stock market investmentS the time necessary to cash the sum invested can reach a month or longer.

Do not forget that the heirs are legally entitled to export the money inherited only if they can show a clear proof that the de cuius, (the deceased) had previously transferred it from abroad (TT3 form).

HOW TO MANAGE CONDOMINIUM PROPERTIES

In case of inheritance of a condominium registered in the name of the deceased, the heirs will be entitled to transfer it to their own name or to sell it, but they will be allowed to transfer abroad only the amount corresponding to the Land Department's estimateD sale-price as shown in the official and registered sale-contract, not one baht more.

Furthermore, in case of inheritance of real estate, remember that if you transfer the property (title deed) TO your own name then resell it before 5 years, you will pay an extra, very heavy tax which can reach 10% of the estimated value.

Also remember that to transfer the property of a condominium unit, it is necessary to present an "non debt certificate" officially issued by the condominium's juristic person manager. If the buyer is a foreigner, he must provide the documentation (TT3) that the money corresponding to the price of the sale came from abroad.

WHAT HAPPENS TO LAND AND HOUSES

- If the de cuius owned houses or land, and HAD registered them in the name of a company, the heirs will inherit only the shares that were officially registered in the name of the de cuius and this opens a very delicate issue and a real conandrum.

What will be of the property? As you possibly know, according to the law, a foreigner can not own more then 49% of the shares of a Thai company. The remaining majority of 51% must be in Thai names. As we all know many foreign nationals "buy" houses and land "in company names" using Thai nominees as share holders. In such a case, unless the deceased had wisely provided to name one of his heirs as co-director, the company's share holders are supposed to call a general meeting and ARE entitled to appoint a new director. This will open the door to a dangerous and very uncertain situation. The best way to protect our interests and the ones of our heirs would therefore be to appoint a co-director among the heirs or to stipulate a long term lease specifying in a last will and in the lease contract that the right will be transferred to his/her heirs.

Conclusions: remember that to get an inheritance, in Thailand, is not as easy as it used to be.

Shouting and demanding your rights won't help you at all and in most cases the demands of the various authorities FOR double checking are very justified.

I have personally assisted to incredible cases of stealing of land, condos and houses (which will be the subject of our next article...don't miss it!) and the authorities' extra prudence should be welcomed and appreciated rather then criticized. If you care for your heirs try being provident...until you can.

FAQ - INHERITANCE IN THAILAND

My wife was born Thai and 20 years ago became a British citizen having married me in the UK just over XX years ago. Her family will agree that it was a happy, loving and trusting marriage. She died in Thailand on xxxxx xxxxxxxx and was cremated after 4 days of ceremony.

She has 2 Thai sons by a previous marriage, one is in xxxx, the other is married with a son and wife and a son & daughter. I bought a house in xxxxxxxx in her name for cash less than 5 years ago - not an expensive house probably about £xxxxxxxx for land and building. My stepson and his daughter do not seem particularly happy to see me. My wife’s sisters & cousins have been incredibly helpful and supportive.

I actually want the 2 sons to have equal shares in her residual estate (the house less expenses) and I want to make a small bequest - say xxxxxx baht to her old school. I want her bank account, which has xxxxxx baht in it for our 4 month holiday in Thailand released to me as soon as possible. Funds were electronically transferred from my personal bank account to my wife's Thai bank account proving that it is my money and not part of my wife’s estate. I want the house sold and my expenses such as medical expenses of £xxxxxx and funeral expenses of about £xxxxxx repaid to me from the estate - from which I will make my donation. I would expect your fees to be covered by the estate.

We lived in England for most of our married life and have now moved to xxxxxxx. The house in xxxxxx is owned in my name only. I expect that as she died without a will in any of the 3 countries each will treat her death in their own way and limit themselves to their national borders.

Dear Sir,

Your request, due to its complexity, does require a thoroughly examination which cannot be done online or via email.

However, I can anticipate that it would be extremely difficult, if not impossible, to appoint as EXECUTOR a third party rather than one of the legit heirs, especially if there will be any possible quarrels, contestations or disagreements between the heirs.

Provided that there will be no contestations, to be appointed as executor, you will be requested to exhibit the WRITTEN CONSENT of all legit heirs and to physically appear in court the day of the hearing; then return to Thailand a SECOND TIME to take possess of your part of the heritage.

I remind you as, if your wife has deceased without leaving a testament (last will), the legit heirs will be:

- The spouse in the measure of 50% of all assets acquired during a common-law marriage.

- The remaining assets will be assigned in equal parts between the spouse, the children and, if still alive, the parents of the deceased.

- You will be obliged to sell your share of the land and house within one year

In other words, we strongly suggest you to find an agreement with the other legit heirs.

The standard cost of the procedure to be appointed as executor, assuming that you will be able to provide all the requested documentation as described in our website will be xxxxxxxxxx THB, to be paid in advance, in two instalments, no later than the first hearing, after we will have controlled the completeness of the requested documentation.

Please note that the estimate does not include a legal suit in case of litigation.

We are not competent for the attribution of heritage outside Thailand.

FAQ

Dear Estate Lawyer Thailand,

Hi my name is xxxxxx. My father died in thailand in xx xxxx. I am trying to collect his belongings money in his bank account and everything he had. As I live in the UK I am having trouble in doing so.

My father lived with a Thai lady but they were not married. She has his passport death certificate and bank details and will not communicate with me or release them to me as she is trying to get his money.

Will she be able to get his money out of his account and could u help me with this matter.

All help is much appreciated

Thank you

XXXXXX

Answer:

Dear Mr. xxxx,

There are many points to consider:

- Has your father made a last will?

- If so who is or are the beneficiaries?

- Was he married?

- Are you the only inherit?

- Do you have a list of his assets in Thailand including bank accounts, properties etc.?

- Do you know the name and the address of the Thai lady?

- Do you have her telephone number or contact?

If she's not the legitimate inherit she can't take possession of the assets of a deceased person and, if she does, it is serious a crime.

If you are the legitimate inherit you can apply to be appointed as executor, but to do so you need to presents several documents as you can see in our page

Inheritance - Succession Lawyer Bangkok Thailand - How to take possession of an Estate (inheritance) in Thailand. Our English speaking Bangkok Lawyer specialized in Succession can assist you in all the provinces of Thailand, including: We can assist you whererever you are in Thailand including: can assist you in all Thai Provinces including:

Bangkok Succession Attorney (กรุงเทพมหานคร), Pattaya (พัทยา) Rayong (ระยอง), Chonburi (ชลบุรี), Lawyer Trat (ตราด), Krabi (กระบี่), Udon Thani (อุดรธานี), Ayutthaya (พระนครศรีอยุธยา), Lop Buri (ลพบุรี), Nakhon Nayok (นครนายก), Nakhon Pathom (นครปฐม), Nakhon Sawan (นครสวรรค์), Nakhon Si Thammarat (นครศรีธรรมราช), Phang Nga (พังงา), Ranong (ระนอง), Songkhla (สงขลา), Surat Thani (สุราษฎร์ธานี) Lawyer Koh Samui (เกาะสมุย), Chiang Rai (เชียงราย), Lampang (ลำปาง), Mae Hong Son (แม่ฮ่องสอน), Kanchanaburi (กาญจนบุรี), Nonthaburi (นนทบุรี), Phetchaburi (เพชรบุรี), Buri Ram (บุรีรัมย์), Chaiyaphum (ชัยภูมิ), Khon Kaen (ขอนแก่น), Mukdahan (มุกดาหาร), Nakhon Phanom (ระยอง) Phuket (ภูเก็ต), Chieng Mai (เชียงใหม่), Phitsanulok (พิษณุโลก), Sukhothai (สุโขทัย), Samut Prakan (สมุทรปราการ), Samut Songkhram (สมุทรสงคราม), Saraburi (สระบุรี), Suphan Buri (สุพรรณบุรี), Chachoengsao (ฉะเชิงเทรา), Chanthaburi (จันทบุรี), Prachin Buri (ปราจีนบุรี), (นครพนม), Nakhon Ratchasima (นครราชสีมา), Nong Khai (หนองคาย), Sakon Nakhon (สกลนคร), Surin (สุรินทร์), Ubon Ratchathani (อุบลราชธานี),